Keywords:

|

| Biopharmaceuticals, biologics, regulatory, patent. |

INTRODUCTION:

|

| Biopharmaceuticals are drugs usually complex molecules derived from living organisms. It is most difficult to manufacture, quantify and purify them. Many first-generation biopharmaceuticals, including erythropoietin, human growth hormone, human insulin etc. which have come off patent or lose marketing exclusivity, have opened the door for the manufacture of generic biopharmaceuticals which are otherwise called as biogenerics. Copied versions of the biopharmaceuticals are biogenerics. When compared to traditional pharma products, they are more specific, less toxic and offer better survival benefits, disease modification & pharmaco-economic benefits to patients. But, because of their complex nature they are difficult to consistently manufacture in quality and quantity. At the same time, due to lack of specific regulations, approval of biogenerics in India became difficult task. [1, 2] |

DISCUSSION:

|

| Why Biogenerics? |

| 1. About two dozen biologics are likely to have lost patent protection in the United States by 2010. |

| 2. Appreciable market size for these biologic products. |

| 3. ‘Replication’ of biologic products attributed to technological advancements. |

| 4. High prices of branded biologics have historically restricted usage, but lower prices of biog |

| 5. Increasing implementation of cost-cutting policies, designed to favor generic usage, by the Government. |

| 6. Indian companies can establish expertise in biogenerics, which can then be transferred to more established pharmaceutical markets, while regulations in the United States and Western Europe are being sorted out. |

| Biogenerics are becoming technologically feasible and financially necessary, therefore are gaining regulatory and political attention. |

| Indian scenario |

| According to the RNCOS study, out of 40 biologics 25 are biogenerics. Other 25 biogenerics are in their last stages of development.[3] The Indian biogenerics market is expected to grow to $580 million by 2013 from $200 million in 2008 based on the statistics released by Datamonitor, the Indian biogenerics market, which was $200 million in 2008, is expected to grow to $580 million by 2013.[4] |

| Under the Trade-Related aspects of Intellectual Property Rights (TRIPS) agreement, the pre-1995 product patents do not apply in India and this leaves as many as 48 biologicals that were patented prior to 1995, marketable in India. [5] Moreover, the innovators have not wanted patent protection for some drugs in India, thereby creating a strong opportunity for Indian companies to impact the huge domestic market and supply to other countries where these products are not patented. [6] |

| The primary focus within the biopharmaceutical sector in India is concentrating more towards development of biogenerics because of much lower developmental costs and risks lessen spending on research and development, reduced time to market and expertise in reverse engineering drug development process. |

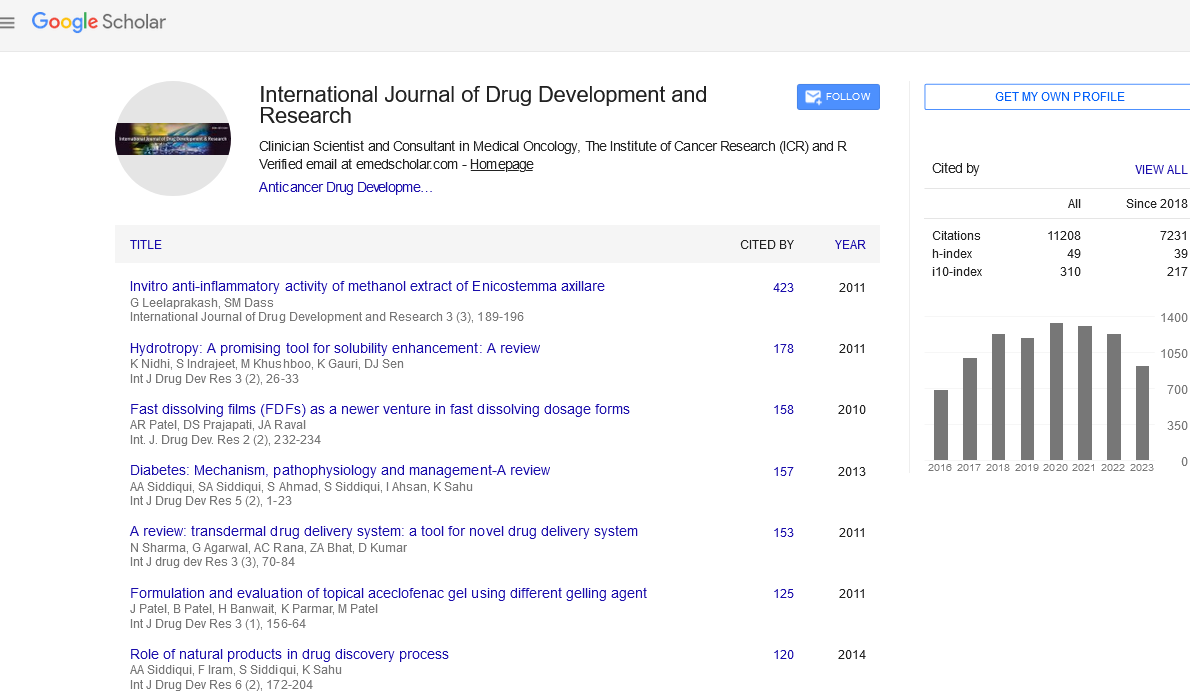

| Off the 50 different brands of biogenerics are approved by more than 20 different biopharmaceutical companies (Table 1) and some of these molecules have finished a decade of market presence with several thousand doses already administered. |

| Currently, there are 14 brands of Granulocyte Colony Stimulating Factor (G-CSF), 16 brands of Erythropoietin (EPO) are available in the Indian market, shows the intensity of competition among the biopharmaceutical companies in India. [8] |

| In India Phase I-II trials are generally not mandatory for biogenerics approval unless it is found needed in special cases. Phase III trials with a minimum of 100 patients are obligatory for establishing bioequivalence. Hence, the full cost to improve a biogeneric in India can range from $10 – 20 million, which supports Indian companies to offer their products at a 25-40% cheaper price than the innovator biologics.[9] Clinicians suggesting biogenerics straightaway after their launch, signifying that the biogenerics have established a good fame among healthcare professionals, which is distinct from Filgrastim, nearly 65 percent of market share is led by generics and Erythropoietin, generic brands have taken 39 percent of the market share.[8] |

| Usually all biotechnological products are free from Indian government price control except Insulin, [10] allowing companies to decide their product price. Therefore, to improve market share the innovator companies lessen the price of their products anything from 30 to 50 percent. |

| Development of biogenerics |

| There are four stages [11] in the development of a biogenerics: |

| 1) Product development and comparative analysis |

| 2) Process development, scale up and validation |

| 3) Clinical trials |

| 4) Regulatory (EMEA, WHO and FDA) review and approval. |

| All stages come with varying requirements and take varying extents of time contributing to the total cost of developing a biogeneric. |

| 1. Product development and comparative analysis: This stage includes the production of protein of interest from cell culture and confirms their stability. The product must also demonstrate that it is biogenerics to the innovator product. |

| 2. Process development, scale up and validation: In this stage, scale up of manufacturing process can be carried out to increase the product yield. This process should be conducted under good manufacturing practices and reproducibility of the manufacturing process needs to be demonstrated. |

| 3. Clinical trials: In order to demonstrate bioequivalence to innovator product, clinical trials will be essential for almost all biogenerics products. |

| 4. Regulatory review and approval: |

| The regulatory pathway used for the approval of biogenerics must speak about the characteristics of biogenerics that distinguish them from conventional generic drugs or more broadly the way in which biologics differ from New Chemical Entity (NCE) - based drugs. |

| In Europe: |

| In Europe, the Committee for Medicinal Products for Human Use (CHMP), the European Medicines Agency (EMEA) directed the way for biogenerics, by issuing its first specific regulatory guidance in October 2005. [13] Two general guidance documents speaking about quality and nonclinical and clinical perspectives (Feb 2006), [14, 15] five product specific annexes on nonclinical and clinical issues (June-July 2006)[16] and a manufacturing change comparability guideline (Nov 2007) are now available. |

| WHO guidelines are adopted in October 2009, provide universally acceptable principles for licensing Similar Biotherapeutic Products (SBPs) that are claimed to be similar to innovator biological products of assured quality, safety and efficacy that have been previously licensed based on a full licensing dossier. [17] |

| Valid Guidelines: [17] |

| Two guidelines help with the quality requirements of the dossier: |

| • Guideline on Similar Biological Medicinal Products Containing Biotechnology-Derived Proteins as Active Substance: Quality Issues (EMEA/CHMP/49348/05) Publication date: Feb 2006; Effective date: Jun 2006 |

| • Guideline on Comparability of Medicinal Products containing Biotechnology-derived Proteins as Active Substance -Quality Issues (EMEA/CPMP/BWP/3207/00 Rev. 1) Publication date: Dec 2003; Effective date: Dec 2003 |

| The following three essential guidelines give advice for the pre-clinical and clinical section of the dossier. |

| • Note for Guidance on Comparability of Medicinal Products Containing Biotechnology derived Proteins as Drug Substance - Non Clinical and Clinical Issues (EMEA/CPMP/3097/02) Publication date: Dec 2003; Effective date: June 2004 |

| • Guideline on Similar Biological Medicinal Product (EMEA/CHMP/437/04) Publication date: Sep 2005; Effective date: Oct 2005 |

| • Guideline on Similar Biological Medicinal Products Containing Biotechnology-Derived |

| • Proteins as Active Substance: Non-Clinical and Clinical Issues |

| In United States: |

| Biologics are regulated independently from other drugs under federal law. The Biologics License Application (BLA) is a request for permission to introduce, or deliver for introduction of a biologic product into interstate commerce (21 CFR 601.2). The BLA is regulated under 21 CFR 600–680. |

| Approval Process for Biologics: |

| Under the BPCI, a sponsor may look for approval of a “biosimilar” product under new section 351(k) of the Public Health Service Act that creates an abbreviated approval pathway for biological products that are “highly similar” (i.e.,biosimilar) to, or further proven to be “Interchangeable” with an FDA-licensed biological product. |

| There are two distinct regulatory pathways for biologics are associated with a different set of barriers for approval of Biosimilars. [12] |

| Overview of biogeneric regulation in India: |

| Drug and Cosmetic Act (DCA) is the statutory body involved in India’s drug regulation policies stem. The DCA was passed in 1940, which has been amended several times and provides the bulk of the regulatory material required for India’s drug industry. Indian drugs are being regulated by administrative agencies also, and these agencies are being authorized by DCA for discretionary decision making, but, more so than |

| China’s Drug Law. DCA specifies a number of registration procedures directly. |

| India lacks State Food and Drug Administration (SFDA) counterpart. In India, instead of SFDA there are several government agencies and committees which regulate new drugs and generics. They are [12, 18, 19, 20] |

| 1. The Central Drugs Standard Control Organization, headed by the DCGI, or the Drug Controller General of India |

| 2. The Ministry of Environment and Forests. |

| 3. The Department of Biotechnology |

| 4. The Review Committee on Genetic Manipulation (RCGM) |

| 5. The Genetic Engineering Approval Committee (GEAC) |

| 6. A multitude of Institutional Biosafety Committees (IBSCs) |

| 7. Ethics committees attached to India’s hospitals and animal testing laboratories. |

| The functions of the above regulatory authorities are given in the table 3. |

| Indian regulatory process for biogeneric products |

| As yet there are no distinct guidelines for approving biogenerics in India. As per the Indian regulatory authorities biogenerics as new biotechnological products and follow the “Rules for the Manufacture, Use, Import, Export and Storage of Hazardous Microorganisms/ Genetically Engineered Organisms or Cells, 1989” outlined by the Ministry of Environment & Forests (MoEF) under the Environment (Protection) Act, 1986. [19] The MoEF had setup a Task Force on Recombinant Pharma Sector under the Chairmanship of Dr.R.A.Mashelkar, Director General, Council of Scientific and Industrial Research in 2004. This has outlined protocols for 5 different scenarios for each of, which committee clearances are mandatory, which were adopted by Government of India in 2006. [21] |

| For example, end product is not a Live Microorganism (LMO) could be: |

| 1. Indigenous product Development, Manufacturing & Marketing (IBSC, RCGM & DCGI). |

| 2. Import and Marketing (DCGI). |

| End product is a LMO are evaluated under the following heads: |

| 1. Indigenous product Development, Manufacturing & Marketing (IBSC, RCGM, GEAC & DCGI). |

| 2. Import and Marketing (GEAC, DCGI). |

| 3. Import of bulk, for Manufacturing & Marketing (IBSC, RCGM, GEAC and DCGI). |

| Steps involved in the regulatory pathway for the approval of new biogenerics in India are shown in Table 4. |

| Recently the DBT has provided a set of “guidelines for preclinical evaluation of similar biologics in India” to approve the biogeneric products. |

| Lack of Specific Regulations |

| While the abbreviated pathway for approval of biologics is new, the European Union under the regulation of the European Medicines Agency (EMA) has had general guidance in place since 2005 and has published a number of specific guidance documents on nonclinical, clinical, and quality issues for biosimilars. |

| The EMA also has provided guidelines on specific biologic classes, including insulin, somatropin, granulocyte-colony stimulating factor, a draft guidance on monoclonal antibodies, and concept papers on low-molecular weight heparins and interferon alfa. European regulations have no equivalent to the “interchangeable” designation in the BPCI and European countries presently do not allow automatic substitution of a biosimilar. Fourteen biosimilars of three reference products (erythropoietin, filgrastim, somatropin) have been approved by the EMA since 2006 |

| `According to the Committee for Proprietary Medicinal Products (CPMP) at the EMEA (European Medicines Evaluation Agency), there are no 'universally' applicable guidelines and each product may have to be reviewed on a case-by-case basis. Hence when compared to Europe, India lacks abbreviated pathway as well as specific guidelines for the approval of biogenerics. But India has some advantages over other countries to make it as a leading producer of biogenerics in the global market. They are: [23] |

| 1. Highest number of plants approved by US FDA: One of the main strength India has is that it has the largest number of USFDA approved manufacturing plants outside the US. |

| 2. Booming clinical trials and clinical research: Increasing compliance of Indian companies with GCP guidelines, hospitals and clinics is gaining access to vast and diverse disease populations. |

| Availability of highly qualified human resources: Abundance of English speaking medical professionals and personnel with close to 7, 00,000 PG’s and 1500 PhD's qualifying in engineering and biosciences each year. As high as 30% scientists and qualified personnel are being employed in R&D by most of the biotech companies. |

| 4. Lower operational and capital costs: This is advantageous because the manufacturer needs to invest less time and money into the clinical development of the new compound. |

| 5. Highly competitive bioprocessing skills in pharma sector: It has proven that Indian pharmaceutical industry is globally competitive in fermentation-derived pharmaceuticals which transforms and leverages production of biogenerics. |

| 6. Excellent opportunities in genomic research: Factors like plant, animal and microbial diversity present excellent genomic research opportunity. |

Conclusion:

|

| In the terms of biogeneric industry, Indian pharmaceutical companies have higher scope over other firms. Presently India is booming as a major contributor in world biogeneric market. One of the main strength India has is that it has the largest number of USFDA approved manufacturing plants outside the US. Booming clinical trials and clinical research have added another feather on the cap of Indian companies. Very low cost infrastructures and highly educated citizens, and day by day increasing number of PG’s, PhD's qualifying in engineering and biosciences each year, provide the ideal combination for entering such a complex and non-established industry. There is a need of establishment of a “learning curve” for Indian firms for better understanding of manufacturing of such products and dealing with the complex regulatory environment. But the disappointing side is that there is lack of specific regulations for the approval of a biogeneric in India. Hence to raise India from a complex, competitive environment and shine as a leading producer of biogenerics which calls for an immediate need for establishment of proper regulatory standards in India. |

Tables at a glance

|

|

|

|

|

| Table 1 |

Table 2 |

Table 3 |

Table 4 |

|