Research Article - (2023) Volume 15, Issue 5

“Improving efficiency in healthcare: Effects of deploying electronic claims management system on the implementation of a sub-national health insurance schemes in Anambra state, Nigeria”

Uchenna Ezenwaka1,2 and

Simeon Onyemaechi3*

1Department of Health Administration and Management, Faculty of Health Science and Technology, University of Nigeria Enugu Campus, Enugu, Nigeria

2Health Policy Research Group, College of Medicine, University of Nigeria Enugu Campus, Nigeria

3Anambra State Health Insurance Agency, Awka, Anambra State, Nigeria

*Correspondence:

Simeon Onyemaechi, Anambra State Health Insurance Agency, Awka, Anambra State,

Nigeria,

Tel: +234 8036740872,

Email:

Received: 22-Jul-2023, Manuscript No. ipaom-23-13961;

Editor assigned: 24-Jul-2023, Pre QC No. P-13961;

Reviewed: 05-Sep-2023, QC No. Q-13961;

Revised: 11-Sep-2023, Manuscript No. R-13961;

Published:

19-Sep-2023

Abstract

Objective: As healthcare becomes increasingly important to the

economic and social development of any nation, the problems

healthcare providers face in terms of efficiency and speed of

service delivery need to be addressed. By deploying an electronic

claims management system, these issues can be resolved, leading

to improved efficiency in healthcare. This study examines the

effects of deploying an electronic claims management system on

the implementation of a sub-national health insurance scheme in

Anambra State (ASHIS), Nigeria.

Methods: A qualitative study was conducted in Anambra state,

Nigeria. Data were collected from stakeholders- health insurance

managers and ASHIS-accredited healthcare providers- who play

critical roles in claims management. Twenty in-depth interviews

were conducted with the stakeholders to explore their experience

and effectiveness of electronic claims management system. Data

were analysed using a thematic approach.

Results: Manual claims management was stated to be cumbersome,

time-consuming and error prone. The analysis revealed that

implementation of the electronic claims management system

increased the efficiency of the ASHIS in terms of speed, accuracy,

transparency, convenience and cost savings. Furthermore, the

system also resulted in greater customer satisfaction among the

health service users. However, few respondents claimed that poor

internet connectivity often challenges the process.

Conclusion: The study highlights the importance of deploying

electronic claims management systems in providing efficient

healthcare services, hence, the need to ensure its sustainability.

Keywords

Anambra state health insurance scheme; Claims; E-claims

management system; Reimbursement

Introduction

In recent times, increasing global commitment to

Universal Health Coverage (UHC) has triggered health

financing policies and investments to improve access to

health services and financial risk protection, particularly

in many Low- and Middle- Income Countries (LMICs)

[1]. Globally, social health insurance has been recognized

as a strong and important financing mechanism capable

of enhancing access to care and improving financial

protection by mitigating the detrimental effects of user

fees towards the attainment of UHC [2]. Consequently,

many developing countries have introduced social health

insurance schemes [3,4].

However, the performance of the health financing

mechanisms adopted largely depends on the provider

payment and service delivery methods. Globally, the

predominant Provider Payment Mechanisms (PPM) used

include Fee-For-Service (FFS), capitation, Diagnostic-

Related Group (DRG) and mixed payment methods [5].

Although these PPM assisted in shaping health financing,

health outcomes and access to quality healthcare are

somewhat attributed to the way health providers’ claims

for services delivered are reimbursed [6]. This implies that

the claims management system – submission, processing

and reimbursement of claims is critical to the success of

any health insurance system. For instance, delayed and

unpredictable reimbursement of claims to health providers

is proven to challenge the efficient delivery of healthcare

to clients [7-9] and threatens the sustainability of health

insurance schemes [10].

Manual system of claims management has been proven

to result in unpaid claims due to errors and fraudulent

claims [11]. Evidence shows that given the complex nature

of claims management, the huge cost of a manual (paperbased)

claims management system poses major threat to the

performance and sustainability of health insurance schemes

[12]. Consequently, insurance agencies seek efficient and

innovative methods such as full digitalization of operations

using electronic claims (e-claims) management system

which significantly improve operational efficiency in

healthcare financing, which is considered critical for a wellfunctioning

healthcare system [13].

Several studies have underlined the benefits derived

from digitalizing claims management over a paper-based

claims system, including allowing for cost-reallocation;

facilitating automated pre-payment control; reducing

error and fraudulent claims; providing transparent and

reliable processes; cost-savings by freeing staff from tedious

schedules [14] and reduction of denied claims costs [12].

Hence, digitalizing every step of claims management, from

submission of claims to reimbursement, has the potential

to boost operational efficiency and overall performance of

a health financing mechanism.

As part of renewed efforts at pursuing sustainable

healthcare financing mechanisms that promote UHC,

in 2016, the Anambra state government launched a subnational

social health insurance scheme – Anambra State

Health Insurance Scheme (ASHIS). The goal of the scheme

is to provide access to quality, affordable and efficient health

services for every resident of the State [15,16]. The scheme

which commenced in 2018 is managed by the Anambra

State Health Insurance Agency (ASHIA). The principal

objective of the agency is to promote, regulate, supervise,

implement, and ensure the effective administration of the

scheme [15].

The membership of ASHIS comprises all residents

of Anambra State including employees of the public and

Organized Private Sector (OPS), employees in the informal

sector, and vulnerable persons [15]. The scheme is financed

through premiums (basically payroll taxes and private

contributions), state government subsidies (general and

earmarked taxes), and other sources such as donations,

donor funds, etc. [15]. Actuarists determine the premium

rate be contributed. The ASHIA operational guideline

specifies the contributions as follows: i) Earnings for the

public and OPS employees where an employer pays 10 per

cent of the basic salary while the employee contributes 5 per

cent of the basic salary to cover a principal with the spouse

and four biological children below 21 years. For employees

of the OPS, the employer may decide to pay the entire

contribution for the employees. ii) Equity fund established

for the vulnerable persons. iii) Fixed contributions for

the informal sector. In addition, an enrolee makes a copayment

of only 10 per cent of the cost of medications

prescribed by the Health Care Providers (HCPs) at the

point of care whether as outpatient or inpatient [15,16].

The scheme operates a single pool as stipulated by the law

which established it. The ASHIS covers a basic package

of services including promotion, prevention, curative and

rehabilitative health care services provided at the primary,

secondary and tertiary levels of care at both private and

public health facilities [15,16]. The provider payment

mechanism is through capitation for primary care and

Fee-For-Service (FFS) for secondary and tertiary care.

Capitation is paid in advance for a defined population

for an agreed amount monthly to the HCPs while FFS is

paid by the agency when claims have been submitted and

processed [15,16].

Claims management was done manually at the

commencement of the scheme in 2018. However, ASHIA

introduced an e-claims management system in early 2022

as a more efficient method of claims management following

anecdotal evidence that manual claim management which

it had employed posed several financial, administrative,

and service delivery challenges such as erroneous claims,

inflation of bills, delays in submission, processing, and

reimbursement of claims to HCPs. These challenges

affected the efficiency and overall performance of the

scheme and therefore posed existential threat to her.

There is a dearth of empirical evidence on the

effectiveness of e-claims management for improving

efficiency in healthcare within ASHIS. In addition, study

designs targeted to evaluate the effect of the e-claims

management system could be informed by operational

research to understand whether the e-claims management

system is achieving its desired objectives of improving

health system performance. Such evidence would inform

policymakers, health insurance managers, health insurance

advocates and HCPs not only in Nigeria but other low-andmiddle-

income countries. The study assessed stakeholders’

experiences on the effects of deploying an electronic system

of claims submission, processing, and reimbursement in

the implementation of ASHIS in southeast, Nigeria.

Methods

Study design and area

This was a cross-sectional qualitative method where an

In-Depth Interview (IDI) was used to collect information

on stakeholders’ experiences of switching from a paperbased

system of claims preparation, submission, processing,

and reimbursement to an electronic method and the effects

of e-claims system on the implementation of ASHIS.

The study was conducted in Anambra state, Nigeria.

The projected population of the state in 2022 is six million

persons with an estimated annual growth rate of 2.8 per

cent [17]. Politically, Anambra state is divided into three

senatorial zones: Northern, Central, and Southern. The

State has twenty-one Local Government Areas (LGAs)

for administrative purposes. The State Ministry of Health

(SMOH) coordinates the health system which is organized

into three tiers: primary, secondary, and tertiary levels of

healthcare. Anambra State Health Insurance Agency has

the sole mandate of managing the ASHIS. The provision

of healthcare services under ASHIS is done at both private

and public hospitals across rural and urban areas of the

state [17].

Study population and sampling technique

The study involved two categories of stakeholders

- policymaker’s/health insurance managers and ASHIAaccredited

HCPs who are directly involved in claims

management. Junior officers of the ASHIS who are not

involved in claims management and HCPs whose health

facilities are not accredited to provide services for the

scheme were excluded from this study.

Policymakers and health insurance managers were purposively selected to include those who are directly

involved in claims management and approval. These

respondents include the Chief Executive Officer of

ASHIA; the Technical Assistant to the Governor on Health

Insurance; Heads of the various departments of ASHIA

(Marketing and Business Development, Planning Research

and Statistics (PRS), Administration and Human Resource,

Finance, Internal Audit and Accounts, Information,

Communication and Technology (ICT) and Health

Services Standards and Quality Control) and ASHIA

LGA Desk officers. For the health facilities, a multistage

sampling of ASHIA-accredited HCPs was adopted. First,

the state was stratified into three senatorial zones. Second,

Simple Random Sampling (SRS) method was used to

select two senatorial zones. Third, the SRS method was

used to select a total of four LGAs (two per senatorial zone

comprising one urban and one rural LGA in each of the

two selected senatorial zones) to ensure representation of

geographical locations. In the fourth stage, we purposively

selected ten (10) facilities from an updated list of ASHIAaccredited

health facilities for the selected four LGAs on

the basis of number of enrolees managed (above 500),

facility geographical location (five urban and five rural)

and facility ownership (five public and five private) to

explore diverse experience from the respondents. In the

last stage, the respondents, Health Facility Heads (Medical

Directors or Hospital Administrators), from the selected

health facilities were purposively selected based on their

roles. Tab. 1. summarizes the background information of

the respondents interviewed.

| Category |

Location (n) |

Sex (n) |

Ownership of Facility (n) |

| Policymaker |

Urban (2) |

Male (1)

Female (1) |

- |

| Health Insurance Officer/Manager |

Urban (6) |

Male (7)

Female (4) |

- |

| Rural (2) |

- |

| Health Care Provider |

Urban (5) |

Male (7)

Female (3) |

Public (5) |

| Rural (5) |

Private (5) |

| Total |

20 |

20 |

10 |

|

|

|

|

Tab. 1. Background information of the study respondents.

Data collection

A total of twenty (20) In-Depth Interviews (IDIs)

were conducted with the respondents between May and

June 2022 using a pre-tested, semi-structured IDI guide

developed by the researchers. The IDI guide explored

information on how claims are submitted, processed,

and reimbursed as well as its influence on the effective

implementation of ASHIS. The guide was validated by

two health systems expert researchers to ensure internal

consistency and transferability. Data were collected by ten

experienced researchers who were trained for 3 days. The

researchers worked in pairs (an interviewer and a note-taker).

Interviews were conducted in English and were held in

offices or health facilities as convenient for the respondents.

Each interview lasted an average of 40 minutes and was

audio recorded and transcribed. Notes taken during the

interviews were incorporated into the transcripts to ensure

the completeness and accuracy of information. Prior to the

interviews, both written and verbal informed consents were

obtained from all respondents. Permission to audio-record

interviews and discussions was also obtained from each

respondent.

Data analysis

A thematic framework approach involving coding,

charting, and organising the data under themes was used

to analyse the data. Transcripts were manually coded using

a codebook developed by the researchers. The main themes

were deduced from the study objectives. The themes were

generated by reading the transcripts and reflecting on how

claims are managed and their effect on the implementation

of ASHIS. Inter-coder differences were resolved by

consensus. The main themes explored included: i)

experience with use of the manual and electronic claims

processing systems of claims management and ii) effect or

outcome of the e-claims management system on the health

insurance scheme implementation.

Results

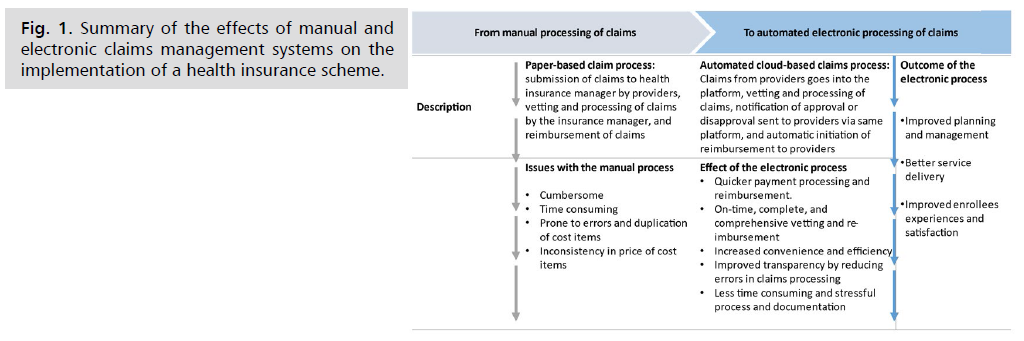

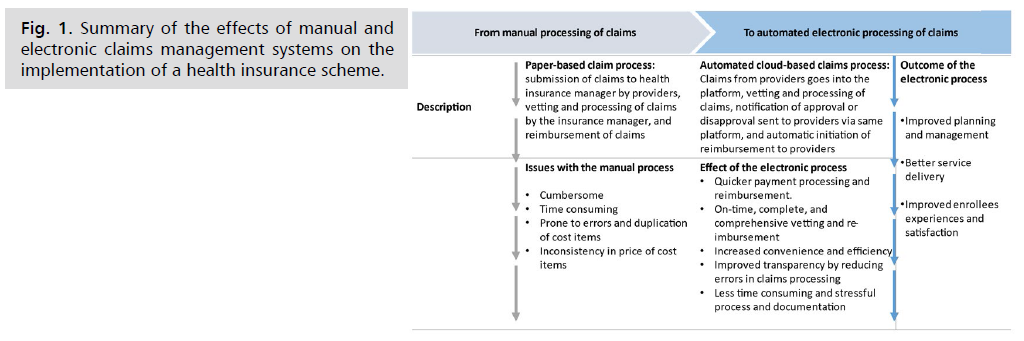

The findings of the study are presented under two headings as described in the data analysis subsection. The summary of the findings is outlined in Fig. 1.

Fig. 1: Summary of the effects of manual and electronic claims management systems on the implementation of a health insurance scheme.

Experience with manual and electronic systems of claim management

Manual system: At the commencement of the scheme, claims were reported to be manually (paper-based) processed and sent directly to ASHIA for reimbursement. The manual processing of claims was stated by the actors (health insurance managers and ASHIA-accredited HCPs) to be cumbersome, time-consuming, and prone to several errors and duplications on claims reports. According to an ASHIA respondent “when we started we were doing fully paper-based, people will go to the hospital they call us to request for pre-authorization codes, we send we approve the services they should render and deny the ones we don't think are appropriate, and at the end of the month, they will send us their claims, the claims management unit will then work on the claims from the HCPs or hospitals, match the claims with the pre-authorization codes that we had sent, and then after vetting the bills, we (ASHIA) pay directly into the accounts of the facilities” (Health Insurance Manager, 01). From the viewpoint of the health provider, manual processing and submission of claims is a burdensome and stressful task. In the words of a provider “we are always to go to Awka (the capital of Anambra state where ASHIA head office is situated) to submit claims, so every time my desk officer collects transport money from me…. it takes time to do so. By the time one travels to Awka and time for working on the claim report, even, the back-and-forth movement during the vetting of our claims. After everything, ASHIA will now call and tell you that the report has errors and they wouldn’t pay this and that” (Health Care Provider, 18).

Electronic system: Respondents reported that the claim management system had been fully digitalized. Claims submission, processing, and reimbursement were stated to be through an automated electronic end-to-end claims management system introduced by the scheme in early 2022. The e-claims management system was said to be designed to allow HCPs who receive a pre-authorization code (for secondary care for a patient) from ASHIA to complete an ‘Individual Claims Form’ (ICF) and then submit the form to the provider portal. At the end of every month, the system consolidates information from all the submitted ICFs and automatically populates the ‘HCP claims form’. The HCP may also upload supporting information for each individual claim such as operation notes, admission reports, laboratory investigation reports etc. These claims (per HCP) are reviewed via a multilevel process supported by an electronic system. After the vetting, claims queries, denial or approval are initiated.

Both health insurance managers and ASHIA-accredited HCPs had a good knowledge on the timing and the electronic process of submitting and reimbursing claims. In the words of a health insurance manager, “we have done away with the paper-based methods, at this point, every claim management in ASHIA is done fully electronically. The hospitals have a portal they log in, make their request, and we (ASHIA) give them approval and it shows on their dashboard there, they treat the patients and send in their bills, the system vets it, and automatically we (ASHIA) can reimburse the claims” (Health Insurance Manager, 05). Similarly, a HCP alluded that “for the past few months, a new portal where you submit your claims was established and we have been using it for a couple of months now and the structure is good. At the first week of every new month when the claims are being submitted electronically, the reimbursements come at the right time actually as agreed, kudos to ASHIA” (Health Care Provider, 11). Another said, “we have laptops we use to process these claims, the Desk officer does this and I will sign on it and vet it and then we send it to them new every month through email and when it is time for reimbursements, they send the money directly to the bank and we receive the bank credit alert. The new system is very good” (Health Care Provider, 14).

Effect of e-claims submission, processing and reimbursement

Study participants shared their experiences in preparing claims, submission, processing, and reimbursement of claims, their influence on health service delivery and implementation of ASHIS at large. All the respondents interviewed reported that transiting from the manual method of claims management to an electronic-based system has made the process easier and better, leading to better service delivery, improved customer experiences and satisfaction, with overall improved efficiency in the system. According to an ASHIA respondent, “the electronic process is working very well. It has helped us to work better and enrollees do not have to suffer for secondary care they want to receive” (Health Insurance Manager, 06). In the affirmative, a HCP alluded that, “when it comes to reimbursement ASHIA pays and they pay as at when due. ASHIA pay the fee-for-service unless you didn’t send your request. This has helped us with treating our enrolees well and they are happy. Yes, money is everything [laughs]” (Health Care Provider, 18).

Specifically, the respondents mentioned the beneficial effects of the e-claim management system, including i) Quicker payment processing and reimbursement. “We (ASHIA) now operate an online system of receiving claims which makes ASHIA attend to them faster” (Health Insurance Manager, 04). Similarly, HCP held the same view that “there is no delay both in payments of claims, they (ASHIA) pay as at when due. In fact, even the capitation, everything is okay. For now, ASHIA is living above the standard” (Health Care Provider, 10). ii) On-time, complete, and comprehensive vetting, and reimbursement. The e-claim management system was reported to have reduced delays in the vetting and reimbursement of claims. From the experience of the health insurance managers, “during the paper-based system, we (ASHIA) were paying within two months and now we pay our fee for service first of every new month since it is fully electronic. All we do is click on the button (on the digital platform) and it'll calculate everything and we pay. So that’s where we are right now, our journey from paper-based to the fully electronic management system, and we have escaped the complaints on time for paying claims to hospitals arising from the manual system” (Health Insurance Manager, 01). iii) Increased convenience and efficiency. Yes, if I should judge between the paperwork and the computer work, I would say that the computer work is easier for us because then I will pack paper home and I will work, work and work and I will do a lot of photocopies and typing so this computer one is better, easier and saves time than that of paperwork and the submission of claims is smoother than the previous system (Health Care Provider, 18). iv) Improved transparency. Respondents stated that the electronic system removed errors and conflict in vetting claims. v) Less time consuming and stressful process and documentation. Ever since we converted the process to an electronic platform there are no conflicts in the system anymore. Unlike before when we have wrong calculations in the price of e.g., drugs and quantities used. Also, bills were not properly done and sent to us, sometimes the prices are inflated, but now with the help of the electronic system, it is way better this cut-off errors. So, there is no need to check if the hospital entered the wrong drug price, the system automatically does it” (Health Insurance Manager, 04)

Although all the respondents agreed that the electronic system of claims management is very efficient and effective. However, few reported that some HCPs still default in the timely submission of their claim to the ASHIA for reimbursement. Their reason for the late submission of their claims includes the unavailability of the responsible staff and poor internet network access. A health insurance respondent reported, “there are hospitals that are still having delays in sending us their claims, some will give you reasons that their desk officers were not on sit or some went on maternity leave, or some went for their annual leave” (Health Insurance Manager, 02). In agreement, a health provider stated, “there are delays but the reason is from the hospitals. Sometimes network disturbs you when you want to input some data into the system and that becomes a problem. Sometimes, our workers may be lazy to do the work you have to make them do it” (Health Care Provider, 13).

Discussion

This study explored stakeholders’ experiences on

switching from the manual to an e-claims management

system and its influence on service delivery and general

implementation of the ASHIS in Nigeria. The study

reveals that the manual system of claims management

was cumbersome and prone to errors resulting in delayed

reimbursement. This could be attributed to the painstaking

nature of processing paper-based claims which require

more labour strength to accomplish. Our findings agree

with previous studies that report manual submission,

processing, and reimbursement of claims to be associated

with delayed claims reimbursement, and discrepancies in

claims vetting which insignificantly impacted health service

delivery negatively [7-9,18]. Perhaps, continuing with the

manual system of preparing claims and submitting claims

with its lapses might eventually encourage HCPs to limit

or compromise the provision of secondary health services

thus affecting quality access to health care services and the

sustainability of ASHIS. It could also lead to HCPs' lack of

trust and confidence in the system. Our assertion is in line

with a study that reported delay in claims reimbursement as

threat to sustainability of a health insurance scheme [8,10].

The use of an e-claims management system benefits

HCPs by reducing delays in reimbursement, minimising

claims rejection and resultant improved service delivery

compared to a paper-based system. The e-claim system

was demonstrated to be efficient due to its ability to detect

or flag errors that cannot be identified by the paper-based

system due to its programming nature. Hence, preventing

human entry errors associated with claims preparation,

submission, and processing, unlike the paper-based

system. This implies that the HCPs and health insurance

managers benefit more from processing claims using the

electronic system than the manual one thereby achieving

more efficiency in healthcare. The implication is that

the “digitalization effects” are achieving their objective

of enhancing efficiency within ASHIS. Our finding is

similar to a study that outlined the benefits of digitalizing

claims management in a health insurance scheme [11,14].

In addition, our findings revealed adequate capacity in

terms of timing and step-wise processes for submitting

and reimbursement of claims using the newly introduce

e-claims system. This suggests that the providers had been

sufficiently educated on the guidelines or procedures for

preparations and submission of claims. Previous studies

have reported long delays in reimbursement of claims to be

due to unclear claims reporting procedures [19,20].

The outlined beneficial effects of implementing

an e-claims management system including faster

process, increased convenience and efficiency, improved

transparency, and reduction of errors/fraudulent claims were

found to lead to build trust and confidence in the system

which ultimately promoted better patient experience and

satisfaction, improved healthcare, and overall performance

of the scheme. This is consistent with a previous study

in reporting that lack of transparency in claims led to

delays in reimbursement of claims, inefficiency, and high

cost of healthcare services [21,22]. More so, large-scale

experimental studies on the digitalization of payments in

other sectors have demonstrated its benefits [23].

However, while this study demonstrates that the

e-claims management system was beneficial to providers

and ASHIA compared with paper claims processing, the

economic implications- costs and benefits of processing

claims manually or electronically to the system is yet

unknown. Hence, further study is needed to evaluate the

Cost-Benefit Analysis (CBA) of e-claims compared with

the paper-claims management system and to establish

whether the marginal benefits of electronic processing of

claims cover its marginal cost (positive net benefits) or

not, thus providing evidence-based information on which

claims processing type provides Value-for-Money (V4forM)

to both providers and the overall health system.

The main strength of this research is the representation

and mix of stakeholders; HCPs of health facilities (public private and urban-rural health facilities) and ASHIS

managers. This allowed for diverse experiences and views

from stakeholders who are directly involved in claims

management and service delivery thereby contributing

to the richness and robustness of the findings. More so,

the study used a probability sampling technique to select

health facilities and participants to share their experiences

on the subject matter which may necessarily represent the

views of the larger population.

The main limitation was that the study used only a

qualitative method to assess the effect of the two claims

processing types among HCPs and ASHIS managers.

Hence, the design did not permit measuring the magnitude

of the effect of the e-claims management system on the

implementation of the scheme.

Conclusion

The study demonstrates the effectiveness of employing

an e-claims management system over a manual system.

The e-claims submission, processing and reimbursement

improved efficiency and led to better service delivery

and performance of ASHIS. It is recommended that the

health insurance agency should make effort to ensure the

sustainability of the electronic claims management system,

with plans for continuous improvement.

Ethics Approval and Consent to Participate

The study obtained an approval from the Health

Research and Ethics Committee of the State Ministry

of Health Awka, Anambra State, Nigeria (Ref. no. MH/

AWK/M/321/408).

Following ethical approval, permission to conduct

data collection was obtained from the management of all

the selected health facilities. This study was conducted

in accordance with the Declaration of Helsinki. All

participants provided both written and verbal informed

consent. Participants were informed of the purpose of the

research, rights of participants and measures that will be

taken to protect them and their data. Hence, participation

was voluntary, and confidentiality was assured. Written

and verbal permission to audio-record interviews was also

obtained from respondents.

Acknowledgment

We thanked the research assistants who assisted in the

data collection. We also appreciate the management of the

health facilities for granting approval for the study.

Consent for Publication

Written informed consent was obtained from

the participants to use quotes from the transcripts in

publication.

Availability of Data and Materials

The data generated and analyzed in this study are not

publicly available due to limitations of ethical approval

involving patient data and anonymity but are available

from the corresponding author on reasonable request.

Competing Interests

The authors declare that there is no competing interest.

Funding

The authors received no financial support for the

research and/or publication of this article.

Authors Contributions

UE and SO conceptualized, designed the study

protocol and data collection instruments. UE analyzed the

data. UE and SO wrote the first draft of the manuscript.

Both authors reviewed and approved the final version for

journal submission.

References

- World Health Organization. Primary health care on the road to universal health coverage: 2019.

- Spaan E, Mathijssen J, Tromp N, et al. The impact of health insurance in Africa and Asia: A systematic review. Bull World Health Organ. 2012;90:685-692.

Google Scholar, Crossref, Indexed at

- Savedoff WD, de Ferranti D, Smith AL, et al. Political and economic aspects of the transition to universal health coverage. Lancet. 2012;380(9845):924-932.

Google Scholar, Crossref, Indexed at

- Lagomarsino G, Garabrant A, Adyas A, et al. Moving towards universal health coverage: Health insurance reforms in nine developing countries in Africa and Asia. Lancet. 2012;380(9845):933-943.

Google Scholar, Crossref, Indexed at

- De Bruin SR, Baan CA, Struijs JN, et al. Pay-for-performance in disease management: A systematic review of the literature. BMC Health Serv Res. 2011;11(1):1-4.

Google Scholar, Crossref, Indexed at

- Awoonor-Williams JK, Tindana P, Dalinjong PA, et al. Does the operations of the National Health Insurance Scheme (NHIS) in Ghana align with the goals of Primary Health Care? Perspectives of key stakeholders in northern Ghana. BMC Int Health Hum Rights. 2016;16(1):1-1.

Google Scholar, Crossref, Indexed at

- Laar AS, Asare M, Dalinjong PA, et al. What alternative and innovative domestic methods of healthcare financing can be explored to fix the current claims reimbursement challenges by the National Health Insurance Scheme of Ghana? Perspectives of health managers. Cost Eff Resour Alloc. 2021;19(1):1-6.

Google Scholar, Crossref, Indexed at

- Alhassan RK, Nketiah-Amponsah E, Arhinful DK, et al. A review of the National Health Insurance Scheme in Ghana: What are the sustainability threats and prospects?. PloS One. 2016;11(11):e0165151.

Google Scholar, Crossref, Indexed at

- Alawode GO and Adewole DA. Assessment of the design and implementation challenges of the National Health Insurance Scheme in Nigeria: A qualitative study among sub-national level actors, healthcare and insurance providers. BMC Public Health. 2021;21(1):1-2.

Google Scholar, Crossref, Indexed at

- Fusheini A, Marnoch G, Gray AM, et al. Implementation challenges of the National Health Insurance Scheme in selected districts in Ghana: Evidence from the field. Int J Public Adm. 2017 16;40(5):416-426.

Google Scholar, Crossref, Indexed at

- Carroll L. More than a third of US healthcare costs go to bureaucracy. Reuters. 2020;6.

- Adzakpah G, Dwomoh D. Impact of digital health technology on health insurance claims rejection rate in Ghana: A quasi-experimental study. BMC Digital Health. 2023;1(1):5.

Google Scholar, Crossref, Indexed at

- Gille F, Smith S, Mays N, et al. Why public trust in health care systems matters and deserves greater research attention. J Health Serv Res Policy. 2015;20(1):62-64.

Google Scholar, Crossref, Indexed at

- World Health Organization. The role of digital claims management for Estonia’s health insurance: A leverage for making healthcare purchasing more strategic. WHO. 2023;10.

- Anambra State Government. Anambra State Health Insurance scheme Law. 2016.

- https://ashia.an.gov.ng/

- Demographic N. Health Survey. National Population Commission (NPC) [Nigeria] and ICF International. Abuja, Nigeria, and Rockville, Maryland, USA: NPC and ICF International. 2013.

- Akweongo P, Chatio ST, Owusu R, et al. How does it affect service delivery under the National Health Insurance Scheme in Ghana? Health providers and insurance managers perspective on submission and reimbursement of claims. PloS One. 2021;16(3):e0247397.

Google Scholar, Crossref, Indexed at

- Wang H, Otoo N, Dsane-Selby L, et al. Ghana National Health Insurance Scheme: Improving financial sustainability based on expenditure review. World Bank Publications; 2017;14.

Google Scholar, Crossref, Indexed at

- Aryeetey GC, Nonvignon J, Amissah C, et al. The effect of the National Health Insurance Scheme (NHIS) on health service delivery in mission facilities in Ghana: A retrospective study. Glob Health. 2016;12:1-9.

Google Scholar, Crossref, Indexed at

- Fenenga CJ, Nketiah-Amponsah E, Ogink A, et al. Social capital and active membership in the Ghana National Health Insurance Scheme-a mixed method study. Int J Equity Health. 2015;14(1):1-2.

Google Scholar, Crossref, Indexed at

- Hu Q, Xu J, Chu Z, et al. Barriers to acceptance of provider-initiated testing and counseling among men who have sex with men in Shenyang, China: A cross-sectional study. Biomed Res Int. 2013;2013.

Google Scholar, Crossref, Indexed at

- Muralidharan K, Niehaus P, Sukhtankar S, et al. General equilibrium effects of (improving) public employment programs: Experimental evidence from India. Econometrica. 2023;91(4):1261-1295.

Google Scholar, Crossref, Indexed at