Keywords

Health financing; Pharmacy; Regulation; Patient satisfaction; Drugs; Pharmaeconomics; Health services

Introduction

Considerable disparities in healthcare and its related services persist due to medical intervention and its subsequent follow-up requirement. The disparities may reflect differences in access to drugs, consumables and medicines. Increase in patients’ cost sharing at the point of services for medical interventions play a major role in such differences. The magnitude of expenditure incurred on drugs designed to produce a specific reaction inside the body and, the medicines designed to treat or prevent diseases, does not show a similar pattern, particularly in developing countries. The present study analyses how far the hospitals subsidize the household’s expenses on drugs and medicines for their patients. The protection given to the patients by the hospitals through subsidizes, discounts and coupon saw many individuals, families and households benefit from them. It is also noticed that many hospitals switch over to the generics drugs and medicines to reduce the healthcare burden and, hence are not burdened with patenting and brand names. This resulted in more patients’ inflow to the hospitals ensuring high growth and profits. Radical intervention and induction of generic drugs, bulk-procurements of drugs and medicines changed the hospitals’ behavior towards financing their patients. This study aims to examine the pharma-equity, where patients have same opportunities even if the outcomes are unequal, adopted by the hospitals to support their patients, and how far the hospitals retain their patient inflows towards their own growth and development.

Research orientation

Most of the governments across the world have a list of approved prescription of drugs and medicines, which have to be used by healthcare practitioners and also encourage appropriate prescribing behavior and contain spending on medications [1]. It has been found that increasing patients cost sharing is a common mechanism to contain healthcare expenditure. The relationship between medication adherence and income may account for a portion of the observed disparities in health across socio-economic groups [2]. Among the households, drugs, medicines and related care form a substantial portion of out-of-pocket expenditure on health. Estimates from one of the developing countries, by Ravichandran, revealed that over 70% of the total out-ofpocket expenditure is spent on drugs and medicines [3], which is over 26% of the total household’s expenditure, went into healthcare spending in developing countries. This seems to be covering its substantial part by outpatient payments (62.4%) and about 14% is on account of inpatient payments. However, Rao et al., cautioned that rising co-payment may worsen disparities and adversely affect health across the socioeconomic groups [2]. The relationship between the direct and indirect impact of a price change depends on health care subsidizes or health financing/ insurance mechanisms [4].

Hospitals, in general, develop various incentive mechanisms to aid patients in terms of discounting price in drugs and medicines; copayments based on generic drug distribution, and free consultation. Undoubtedly, these approaches are welcomed by patients and, in turn, they promoted hospitals for branding. Scheeweiss et al. found that reference-based pricing could assist in decision modeling for estimating product and service costs for optimal pricing [5]. This led to diversification of services by the hospitals to improve the revenue while customizing the services with the focus on patients’ need which ultimately increase the patient satisfaction [6].

Methods

The sources of data are drawn from the selected hospitals in National Capital Region, India, which is one of the largest metropolitan area in the country with a population of more than 11 million. The present study conducted in four multispecialty hospitals with 500 beds and a super specialty hospital are managed by five different establishments – trust run (TRH), charity based (CRH), corporate managed (CMH), chain-based (CBH) and public sector (PSH). Patients are selected from the hospital’s registration data within the time period of January 2012 - May 2014. About 600 patients were followed or until they discontinued the consultation process – i.e., 60 days duration. Patients are also categorized into “new” and “continuing” patients to account for time trends. Random sampling techniques ensured that selection (of participants) bias is minimized by preventing systematic differences between the treatment groups and the new entrants. The index is based on average copayments amounts per prescription (standardized to 30 days supply) for branded and generic drugs, medicines and consumables. The list of drugs and medicines, and consumables related pricing is drawn from the hospital’s procurement cell. However, pricing of data for the analysis7 is basically culled out from various Monthly Index of Medical Specialties spread over a period of six years, from July 2008 to October 2013. A total of 886 drugs that are approved by Government of India (2013) were considered. Elimination of such a large number of products became imperative due to the following reasons: [1] for consistency, different dosages and strengthens were ignored and only packs containing similar units were included; [2] only government approved drugs, medicines and consumables lists were considered; [3] a simple comparison of formulation packs of comparable size and strength between market price and tender prices were considered. The change in the price has been uneven across the therapeutic categories. The market price of formulation has been obtained from MIMS, India while the tender price has been downloaded from TNMSC website, applicable during 2013-14.

Findings and Analyses

Supply-chain and logistic network

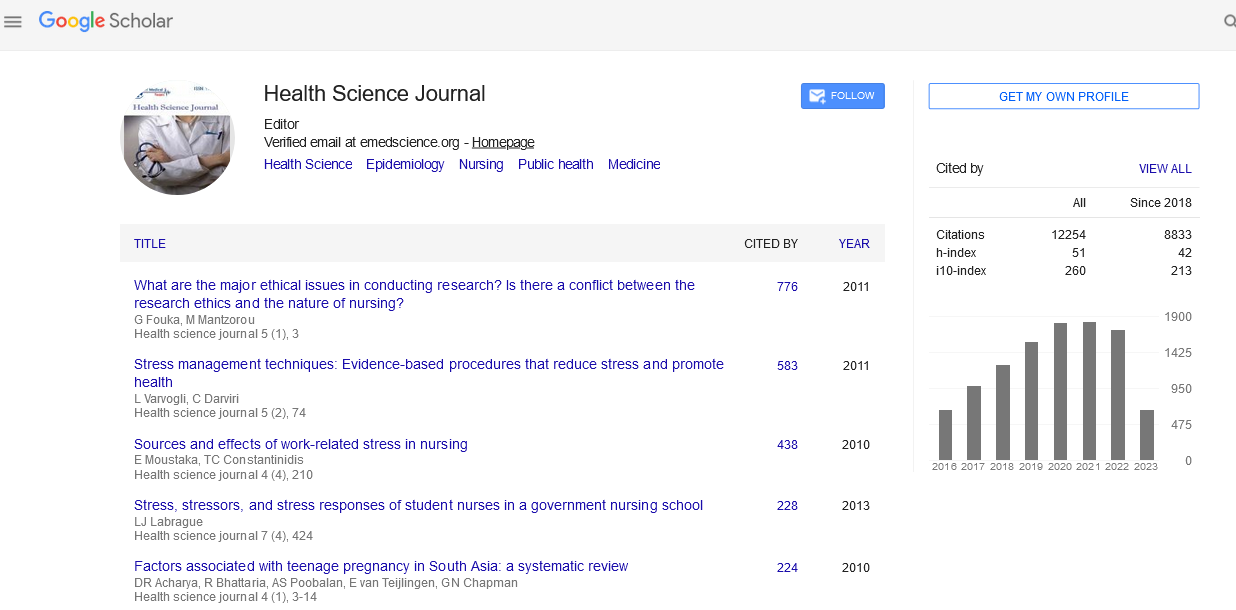

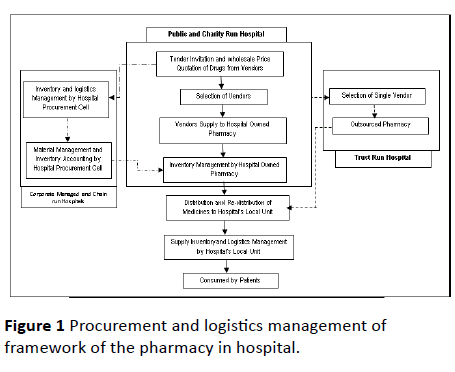

Figure 1 illustrates the procurement and logistics management approaches adapted by the studied hospitals. All studied hospitals begun with the concept of tendering products for price ceiling at the wholesalers’ rate. The PSH and CRH relied on multi-tendering approach to cut the products’ cost whereas TRH carried with single-window vendor approach for procurement and inventory management. While CMH and CBH have their own mechanism and pharmacy unit to manage the entire process of distribution and redistribution. This itself reflects the two-sides of a coin: one side is the fundamental of procurement and, the other is the technical aspect of distribution and re-distribution.

Figure 1: Procurement and logistics management of framework of the pharmacy in hospital.

Skewed stocks

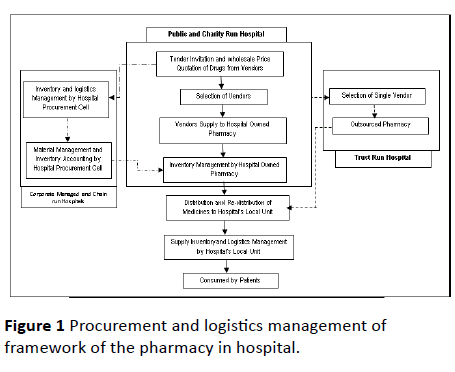

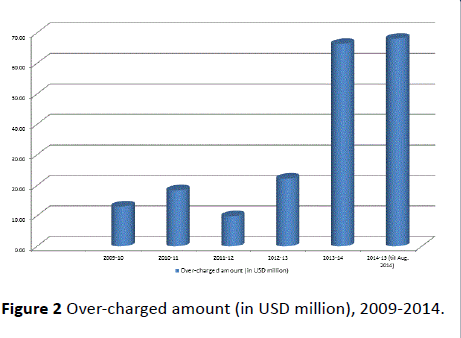

Table 1 illustrates that the irrational/hazardous/nonessential products have flooded in the market and the studied hospitals’ pharmacy as well. Top 25 products enlisted in the hospitals are in the category of irrational products while the others are useless [7]. These products together accounted for nearly 15% in TRH, 8% in CMH and 12% in CBH. For instance, dehydration caused by diarrhea, particularly among children, also accounts for innumerable prescriptions, although dehydration can be easily treated with the combination of simple household items: sugar, salt and water. But, in general, households depend on the ready-made oral rehydration solution packets. Such practices have given rope to hospitals raise the inventory of irrational products in its stocks in order to make more profits. At the same time, it is also noted that the government has reduced the essential drugs/medicines and therapeutic products’ levies, excises duties tax, and other taxes to reduce the healthcare expenditure. Sadly, the National Pharmaceutical Pricing Authority [7] (NPPA) data recorded that during 2009-14, pharma companies have over-charged consumers a total of $ 68.08 million on sale of drugs and medicines. Figure 2 depicts the amount is increasing year on year. Propelled by the booming demand, the production of pharmaceuticals has registered a tremendous increase over the years.

| Name of the Medicine |

Product Category |

Existing MRP (INR) |

New MRP (INR) |

% Change Rate 2008-13 (Reduction) |

| IRRATIONAL/HAZARDOUS DRUGS/NON-ESSENTIAL DRUGS |

| Andant |

Vitamin and Mineral supplement |

27 |

19 |

29.63 |

| Hemolon |

Iron and Vitamin supplement |

55 |

47.5 |

13.6 |

| Bivinal syrup |

Vitamin Supplement |

52 |

47.5 |

8.65 |

| Folinal plus |

Iron and vitamin supplement |

72 |

63.5 |

11.81 |

| Pro HB |

Vitamin and Protein supplement |

55 |

47.5 |

13.64 |

| Respinex |

cough and cold |

49 |

47.5 |

13.64 |

| Alvex syrup |

anti cold and anti histamine |

38 |

29.5 |

22.37 |

| Electro |

Oral dehydration salt |

11.5 |

10.5 |

8.7 |

| Oxicam DT |

anti inflammatory and Analgesic |

30 |

19 |

36.67 |

| Alvizme |

Digests no-enzyme |

15 |

14.35 |

4.33 |

| ESSENTIAL DRUGS |

| Quietal |

anxiolytic sedative hyonotics |

9.5 |

8.5 |

10.53 |

| Worid |

anti helmintics |

12 |

8.5 |

29.17 |

| Exgat 200mg |

Antibacterial |

50 |

42.5 |

15 |

| Piolem 30 |

anti diabetic |

35 |

32 |

8.57 |

| Alcizon 1gm |

anti bacterial |

120 |

90 |

25 |

| * MRP – Maximum Retail Price in Indian Rupees (INR) |

Table 1: Irrational and hazardous and essential drugs rates and reduction.

Figure 2: Over-charged amount (in USD million), 2009-2014.

The dominant proportion of transnational corporation in the productions and sale of inessential and irrational combination of products is apparent from Table 2a that Digests no-enzyme account for 4.33% of irrational drugs to antiinflammatory and analgesic products for 36.67% of nonessential products. This is due to higher profit margins that incentivized hospitals for keeping non-essential and irrational products in volumes instead of better treatment process. This demonstrates that TRH and CBH stocks on high-value, low volume products, while PSH and CRH focus on high-volume and low-value products. This conclusion is based on the review of formulary used in the studied hospitals. The former – TRH and CBH - promotes brand names while the latter - PSH and CRH - by generic brands. Moreover, the studied hospitals do undertake cost studies to determine the products prices. While criteria for defining the cost may vary from one hospital to another, hospitals largely follow mixed-comparablecompetitive approaches of pricing between a new product and that of existing products in the similar therapeutic class and category (Table 2a). Further, it is also observed that all studied hospitals procure drugs, medicines and consumables from pharmaceutical companies or from the whole-sale distributors, though these hospitals sale products on maximum retail price (Table 2b).

| Name of the Medicine |

Product Category |

Existing MRP (INR)* (INR) MRP (INR) |

New (INR) MRP (INR)* |

% Change Rate 2008-13 (Reduction) |

| Amikane 100 |

Antibacterial |

20 |

15 |

25 |

| Aginal 5 |

Cardiovascular |

25 |

19 |

24 |

| Antem |

Gastrointestinal |

20.25 |

16 |

20.99 |

| Lipireg |

Diabetic |

70 |

53 |

24.29 |

| Pyremol |

Antipyretic |

8.5 |

7.5 |

11.76 |

| Oxicam DT |

anti inflammatory and Analgesic |

30 |

19 |

36.67 |

| Berberal |

anti spasmodic |

12 |

10.5 |

12.5 |

| Cetral |

anti-histamines drugs |

25.6 |

19 |

25.78 |

| Pioridel |

Ant diabetic drugs |

52.8 |

37 |

29.92 |

| Lexatin |

Laxative drugs |

37 |

32 |

13.51 |

| Hemostatic 250mg |

Haemostatic’s |

50 |

37 |

26 |

| Alvizme |

Digests no-enzyme |

15 |

14.35 |

4.33 |

| Quitqal |

anxiolytic sedative hypnotic |

9.5 |

8.5 |

10.53 |

| Sicor |

antipyretic and antihistamine |

12 |

10.5 |

12.5 |

| Alsigra |

anti fungal |

72 |

51 |

29.17 |

| Alkacarb |

Urinary Alkaliser |

30 |

25.5 |

15 |

| * MRP – Maximum Retail Price in Indian Rupees (INR) |

Table 2a: Therapeutic drugs and medicine rates (INR) and reduction.

| Name of the Medicine |

Sale Price on MRP (INR) |

Purchase Price (INR) |

| Abmominal sponge |

35.28 |

11.5 |

| Surgolast 10 cm |

160 |

125.82 |

| Carbolfushsin |

105.84 |

89 |

| Mal Card-s |

1176 |

730 |

| Mal Card -x |

1512 |

730 |

| Distilled Water |

133.97 |

69 |

| VelocitPregnan |

550 |

36.66 |

| Clavix 75 MG |

78.84 |

46 |

| Budecort -.5 MG |

96 |

16.39 |

| Dynaplast 10CM |

276.65 |

160 |

| ECG Electrode 1 |

149.93 |

28.8 |

| Gypsona 15- CM |

62.33 |

45 |

| Leucoband -10CM |

211.68 |

160 |

| Micro Pore 29 |

43.11 |

17.5 |

| SodiunHypochlo |

229.32 |

150 |

| * MRP – Maximum Retail Price in Indian Rupees (INR) |

Table 2b: Purchase price by hospital and sale price (INR).

The hospitals have different products and prices at which they regulate profits on the basis of spar e c apacity (T able 3). The hospitals with largest spare capacity have the greatest incentive to drop price while a hospital with less spare capacity cannot make a credible retribution to cut the product price. The spare capacity changing behavior particularly CMH and CBH to prescribe brand names with high margins products, which would increase the revenue while PSH and CRH focus on prescription of generic medicines to reduce the costs to the patients.

| Characteristics |

Charity-run Hospital (CRH) |

Public Sector Hospital (PSH) |

Chain-based Hospital (CBH) |

Trust-run Hospital (TRH) |

Corporate Managed Hospital (CMH) |

| Regulated Pricing on life savings drugs |

✓ |

✓ |

✓ |

✓ |

✓ |

| Control over price updates |

✓ |

✓ |

|

|

|

| Reference Pricing |

✓ |

✓ |

✓ |

✓ |

|

| Positive Lists |

✓ |

✓ |

|

|

✓ |

| Control Over Profit |

✓ |

✓ |

|

|

|

| Patient co-payment |

|

✓ |

✓ |

|

✓ |

| Generic Substitution |

✓ |

✓ |

|

✓ |

|

| Insurance Premium |

✓ |

|

✓ |

|

✓ |

| Discounts |

|

|

✓ |

|

✓ |

| Reimbursements |

|

|

✓ |

✓ |

|

| Subsidies |

✓ |

✓ |

|

✓ |

|

| Coupons/Free supply |

✓ |

✓ |

✓ |

|

✓ |

| CSR based distribution |

✓ |

✓ |

|

✓ |

|

| Tax savings based distribution |

✓ |

✓ |

|

✓ |

|

Table 3: Spare capacity and distribution of benefits’ channel by the selected hospitals.

The spare capacity might induce the behavior of the hospitals from stop purchasing lower-priced drugs and generic drugs, and which would force clinicians and medical practitioners to alter the prescribing behavior (Table 4). The studied hospitals have exercised to reign in drug prices from increasing to unreasonable levels while criteria vary from one hospital to another. The studied hospitals have some form of reimbursement mechanisms to purchase drugs for the benefit of patients. CRH set a policy to regulate the retail price and reimbursable products. In fact, CRH’s 90% of medicines and drugs sold by its pharmacy are on the reimbursable list (Table 4). All reimbursable drugs are controlled with margin of 10-15% below the original prices. In PSH, the prices of prescription drugs that are reimbursable cannot exceed the price of wholesale or average price determined by the National Health Programmes. In addition, reimbursement drug prices; are controlled by reference pricing system in PSH, although prescription drug prices are allowed to be changed freely. The difference that arises between the reference and market prices is to be paid by patients. Whereas TRH sells the products on maximum retail price though it buys the products on tender prices. Interestingly TRH has ethically directed the medical practitioners’ not to indulge in prescribing high priced products and they are also warned, if they do so.

| Dimensions of Spare Capacity |

Charity-run Hospital (CRH) |

Public Sector Hospital (PSH) |

Chain-based Hospital (CBH) |

Trust-run Hospital (TRH) |

Corporate Managed Hospital (CMH) |

| Identifies need to treat |

✓ |

✓ |

✓ |

✓ |

✓ |

| Compare alternatives |

✓ |

✓ |

|

|

|

| Selects best alternatives |

✓ |

✓ |

|

✓ |

✓ |

| Bear the costs |

✓ |

✓ |

|

✓ |

|

| Consume Usefulness |

✓ |

✓ |

|

|

✓ |

| Over the Counter (OTC) |

✓ |

|

✓ |

✓ |

✓ |

| Authorize Purchase (ICU/Nursing) |

✓ |

✓ |

✓ |

|

✓ |

| Prescription only |

|

|

✓ |

✓ |

✓ |

| Prescription only Reimbursed |

|

|

✓ |

✓ |

|

| Profit motives for promotion of branding |

|

|

✓ |

✓ |

✓ |

Table 5: Health financing mechanisms and drug re-distribution management in hospitals.

In PSH, over-the-counter prices are generally free of price control. Although drug prices are largely control free in India, the government fixed a specified discount on the market price to those drugs that are sold to government health schemes and programmes. Apart from this, a few national and international organizations provides funds for drugs or in kind to support patients directly thru public hospital. However, the current funding of drugs by national cancer programme and state government is reported to be inadequate. The hospital makes enough publicity and attracts funds for its cancer patients through donations, individual tax benefits scheme, corporate tax benefits etc. Thus fixing margins on the profits of pharma-companies also forms part of drug price control management. The government controlled and allowed profit margins for wholesalers and retailers are 7% and 20% respectively. But CMH and CBH sells on maximum retail price though it does buy products on wholesale pricing.

Health financing mechanisms thru pharmacoeconomics

However, owing to criticism, the studied hospitals made change in their health financing mechanisms policy to support patients. The objectives of these mechanisms are prescribed in the Table 5. The Table 5 illustrates, market imperfections apart, few standard hospitals make it pertinent to allow for price control, i.e., maximum price charged for specific drugs and medicines.

| Objectives |

Charity-run Hospital (C✓H) |

Public Sector Hospital (PSH) |

Chain-based Hospital (CBH) |

Trust-run Hospital (TRH) |

Corporate Managed Hospital (CMH) |

| Ensure adequate availability of drugs |

✓ |

✓ |

✓ |

✓ |

✓ |

| Provide drugs at affordable prices |

✓ |

✓ |

|

|

|

| Ensure the quality of drugs |

✓ |

✓ |

✓ |

✓ |

✓ |

| Reasonable pricing |

✓ |

✓ |

|

|

|

| Discounts of drugs & consumables |

✓ |

✓ |

|

✓ |

|

| Bulk drugs management |

✓ |

|

✓ |

✓ |

✓ |

| Out sourcing pharmacy management |

✓ |

✓ |

|

✓ |

|

| In house sourcing inventory for profits |

✓ |

✓ |

✓ |

|

|

| Free distribution and charity |

✓ |

✓ |

|

✓ |

|

| Reduce the health care burden |

✓ |

✓ |

|

|

|

| Retain the patients inflow |

✓ |

✓ |

|

|

|

Table 5: Health financing mechanisms and drug re-distribution management in hospitals.

Interaction with corporate managed hospital’s procurement unit revealed that the expenditure on procurement process, inventory management, in-house supply and distribution accounting, and ledger management, logistics and accountancy costs have increased and multi-folded. Due to this, the control prices are being dismantled gradually, although numbers of bulk-drugs prices were brought to minimum level. In CBH, essential category markup of only 10% in view of their importance, the non-essential category 20%, and no margin and/or less profit on life-saving drugs. Similarly, PSH recommends generic medicine which saves upto 60 percent costs of healthcare expenditure. This practice and transparency attracted more patients visiting the hospital for treatment and follow-up care. The price difference between generic and branded drugs is extremely high, which is beneficial to patients, particularly for those who cannot afford.

Discussion

The study shows that the drugs and medicines price rise has displayed an enormous upswing. However, it is also revealed that the initial price per se is fixed with higher profit margins. Corporate managed hospitals keep exorbitant margins, though they purchase drugs at tender prices. The hospital usually sets the purchase prices which are predetermined limits within which the tender prices can be made. The tender price includes transportation, carrying costs and any other expenses that are associated with the delivery (Table 2b). The tender purchase of drugs and medicines by the hospitals has revealed the post-tender margins running into high in retail purchase, and there being no method to determine the margin charged by the hospitals. CRH understood that high profit margin may hurt the patients and it kept drug prices to 12% and 20% of margins for wholesales and retails respectively. This may be resulted in increased patients’ volume at CRH due to health financing mechanisms which benefits patients care.

No systematic pattern or price difference could be deciphered across the studied hospitals. The highest and lowest price differences in the case of non-communicable diseases. “…if one were to convert this price difference and apply it to the entire retail sales, the resulting into trade margin mind-boggling. Pharma companies are not welfare societies and hence one can assume that a normal profit margin has been included in the quoted tender price” [8]. The present day pharma companies are characterized by a complex distribution chain. Therefore, a multi-pronged strategy needs to be devised to smash this network. The essential health care related products shall be procured directly from the pharma companies by a tender purchase price and deploy minimum profit margin as practiced by CRH, it would reduce the health expenditure and also ensure the continuum of care. But in the case of PSH, it lacks funds to support for continuum care, though it advocates for optimum utilization of available resources.

Efficient procurement policies of public sector hospitals have a significant bearing on ensuring right drugs and medicines in sufficient quantities procured at lowest price to get the maximum therapeutic value to few beneficiaries, with available resources. Unlike corporate managed players, the PSH promotes volunteerism to cut the cost for the hospital as well as to reduce the health care expenditure of the patients. Being a public hospital mostly focusing on improving efficiency (1) preparation of an essential drug lists (2) assessment of the quantity of drugs needed, (3) quality assurance from suppliers; (4) procurement process; (5) supply chain management; (6) local purchase; and (7) and prompt payment to suppliers.

The studied hospitals have evolved various models and policy initiatives to improve the outcome i.e., patient inflows while reducing wide disparities in income and socio-cultural behavior. The hospitals attempted to improve their performances by a combination of measures such as availability of drugs, medicines and consumable at affordable prices, greater flexibility in spending, widening the scope for involvement of local unit head and staff. The results are impressive when analyzed in reference to patient inflows and their satisfaction level (Table 6a and 6b).

| Characteristics of Innovation |

Roles and responsibility of Innovation |

Deliverables |

| Public Private Partnership (PPP) |

Contracting private specialist services and out sourcing other services, |

More contractual staff with less investment |

| Decentralization |

Localized decision-making |

Leaning for dynamic model |

| Financing |

User fees, through insurance and donations |

Health pluralisms, patients needs and accessibility |

| Accountability |

Delegation of power to local Unit Heads and Staff |

Promotion of healthcare |

| Community Mobilization |

Linking with government schemes and providing free services |

Integrative financing mechanisms |

| Regulation |

Quality control measures in place and strictly followed |

Continuation improvement of services |

| Drugs Tendering Management |

Tendering drugs, in-house inventory management and distribution |

Cost-effective modeling for financing |

| Pharmacy in-house Management |

outsources pharmacy management |

Cost-controlling |

| Human Resources |

Contracting professional for service delivery, multi-skilling and upgrading skills |

Skilled personnel deployment for short and long term benefits |

| Standard Setting/Accreditation |

Contracting professional for service delivery |

Setting standard for delivery of services |

Table 6a Characteristics of innovation and its roles and responsibility for patient satisfaction.

The studied hospitals tried to reduce the health spending as a result of fiscal pressures and most of them took advantage of available opportunities to achieve whatever they could, underscoring the fact that a limited level of investment can only give a commensurate level of outcome in terms of reducing health care expenditure and improve the patients satisfaction level.

| Characteristics of Innovation |

Public Sector Hospital (PSH) |

Charity-run Hospital (CRH) |

Trust-run Hospital (TRH) |

Corporate Managed Hospital (CMH) |

Chain-based Hospital (CBH) |

| Public Private Partnership (PPP) |

✓ |

✓ |

|

|

| Decentralization |

|

✓ |

|

✓ |

✓ |

| Financing |

|

✓ |

✓ |

✓ |

✓ |

| Accountability |

✓ |

✓ |

|

✓ |

✓ |

| Community Mobilization |

✓ |

✓ |

|

|

|

| Effective communication and networks |

✓ |

✓ |

|

|

✓ |

| Regulation |

✓ |

✓ |

|

|

✓ |

| Human Resources |

✓ |

✓ |

|

✓ |

✓ |

| Drugs Tendering Management |

✓ |

✓ |

✓ |

|

|

| Pharmacy in-house Management |

✓ |

✓ |

|

✓ |

✓ |

| Accreditation |

NABH |

NABH |

|

|

NABH |

| Patient inflow per Day |

850-900 |

650-700 |

150-200 |

300-350 |

350-400 |

| Patient Satisfaction Level |

High |

High |

Low |

Medium |

Medium |

Table 6b: Innovation and patient satisfaction level.

The PSH did take advantage of whatever possible options to mobilize the funds and required support to finance their patients, while CRH did develop its own community health programmes to support its patients. However, corporate managed hospitals neglected these innovative practices though they are created in public-private partnership mode. In contrast, TRH has shown absence in these arenas. The PSH and CRH had inadequate infrastructure and limited investment in developing the critical mass or required skills and human resources while TRH and CMH excelled in this field. In other words, the PSH and CRH have been more cost-effective for the communities while TRH, CBH and CMH neglected in the process led to low level of patient’s satisfaction.

The above findings clearly revealed that if hospitals put little efforts and are willing to reduce their profit margin they could serve large number of patients for their health care and continuum care as well. Such discrepancies should be resolved and only generic products shall be procured and distributed. All hospitals, irrespective of their operational mechanisms, shall advocate for generic drugs. Candidly, the drug regulatory system has been poor and neglected even today, although much has been written and recommended by various committees.

Conclusion

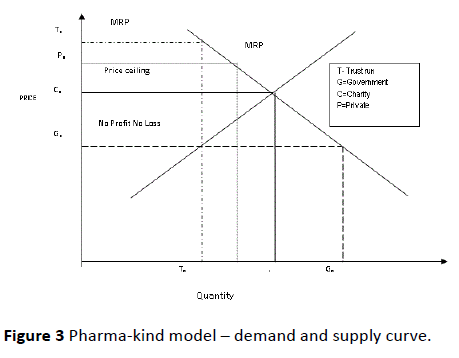

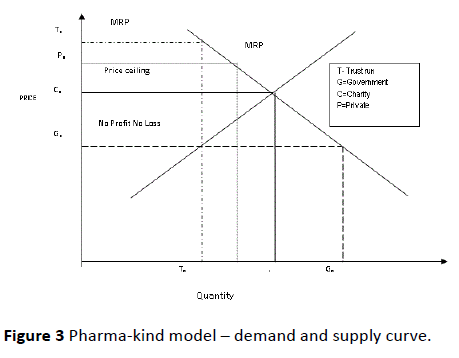

In health economics, both demand-supply curve are employed to control drug cost thru copayments, administered pricing, formularies. However, hospitals, particularly CMHs and TRH are commercial hospitals and want to maximize their profits or cover-up their loss running unit or any other loss making entities. It shows that the conflict of interest could lead to faulty prescribing practices and excessive profit margin. This further depleted and affected their potential patients flow as there is a positive relationship between price and quantum of patients flow. This positive relationship is shown graphically by the pharma-equity model demand-supply curve (Figure 3). If the price changes, there is a momentum in patient flows as well.

Figure 3: Pharma-kind model – demand and supply curve.

The effect of discounts and/or subsidizes, or low profit margin would increase as more patients could afford them. This would result in excess demand, Cq - Tq. This has resulted in CMH, followed by CRH. Whereas corporate managed hospitals face the patient in-flow problems, constraints in attracting patients due to non-financing mechanism and less support to patients. But still they receive certain amount of patients, why? Because, patients do not want incur additional cost for searching another hospital, or to find out an expert outside their vicinity, travel cost and time, waiting time etc. make the patients’ to opt for these hospitals services as they are close by. The extra cost associated with healthcare might mean that households who are not able to afford, prefer visiting public hospitals and/or charity run hospital where patients would get some subsidizes or support for health care. From the study, it is also noticed that public and charity hospitals are willing to find some kind of support mechanism to reduce the healthcare expenditure of the patients. In other words, the regulation of prices is fundamental issue, and complex phenomena. Not only that price discounts or subsidize from maximum retail price have the positive effect to the desired objective of increasing service use, but also improved the patient satisfaction.

At the same time, health financing through drugs means to subsidize and lower the price and increase output. The benefits is distributed to patients and shock is absorbed by the public and charity run hospitals, so that drug prices do not increase beyond optimum level, while neither corporate managed hospitals nor trust-run commercial hospitals are ready to follow the practice. Therefore, author warns merely bringing down the cost of drugs, medicine and consumables will not help patients unless compliance is ensured to induce the equity and increase service utilization. Thus good innovative practices along with pharmacy management can provide effective health financing mechanisms. Unless all stakeholders are brought into accountability by set of values-of compression and human concern for the needy and their related health care, the healthcare expenditure cannot be contained. Thus responsiveness of (the hospitals) supply and demand are important determinants of the effectiveness of drug pricing and control. The government requires taking strong monitoring mechanism to check the wholesale prices by pharma companies and hospitals. As a result, drug profits shall become more transparent, and excessive profits should become more difficult to sustain thru scrutiny. Drug and medicines prices reduction shall be the aim of the government and hospitals to achieve cost-savings thru overall product price cuts if there is no change in prescription behavior.

9840

References

- Lopez Bastida J, Mossialos E (2000) Pharmaceutical expenditure in Spain: cost and control. Int J Health Serv 30: 597-616.

- Rao SV, Kaul P, Newby LK, Lincoff AM, Hochman J, et al. (2003) Poverty, process of care, and outcome in acute coronary syndromes. J Am CollCardiol 41: 1948-1954.

- Ravichandran N (2010) Health Poverty and Equity Mechanism in Philippines. Asian Scholarship Foundation. Cohort 10, Bangkok, Thailand.

- Federman AD, Halm EA, Zhu C, Hochman T, Siu AL (2006) Association of income and prescription drug coverage with generic medication use among older adults with hypertension. Am J Manag Care 12: 611-618.

- Schneeweiss S, Soumerai SB, Glynn RJ, Maclure M, Dormuth C, et al. (2002) Impact of reference-based pricing for angiotensin-converting enzyme inhibitors on drug utilization. CMAJ 166: 737-745.

- Ravichandran N (2015) Diversification: Economies of scale of HR and healthcare indent for benchmarking. Int J HealthcManag 8: 187-193.

- National pharmaceutical Pricing Authority (NPPA) (2014) Centre for drug Price Watchdogs in States. Cap on Med Cost Alone Not Enough. (Accessed from NPPA website on Jan 2, 2015).

- Srinivasan S (1999) How Many aspirins to the rupee? Runaway drug prices. Econ PolitWkly 34: 514-518.